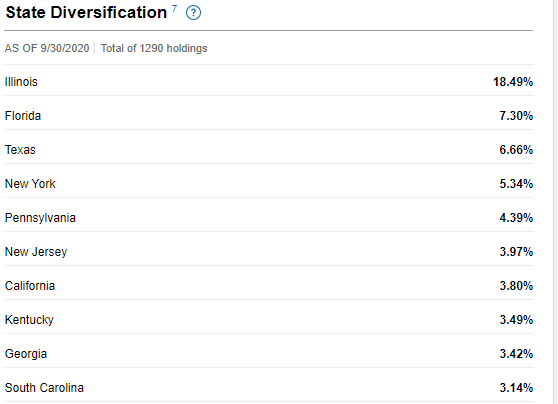

fidelity tax-free bond fund by state 2019

Our funds have star power. Ad Active Transparent Tax-Efficient Time-Tested Core Holdings.

Tax Information Center 2020 Fund Data And Rates Table Fidelity Institutional

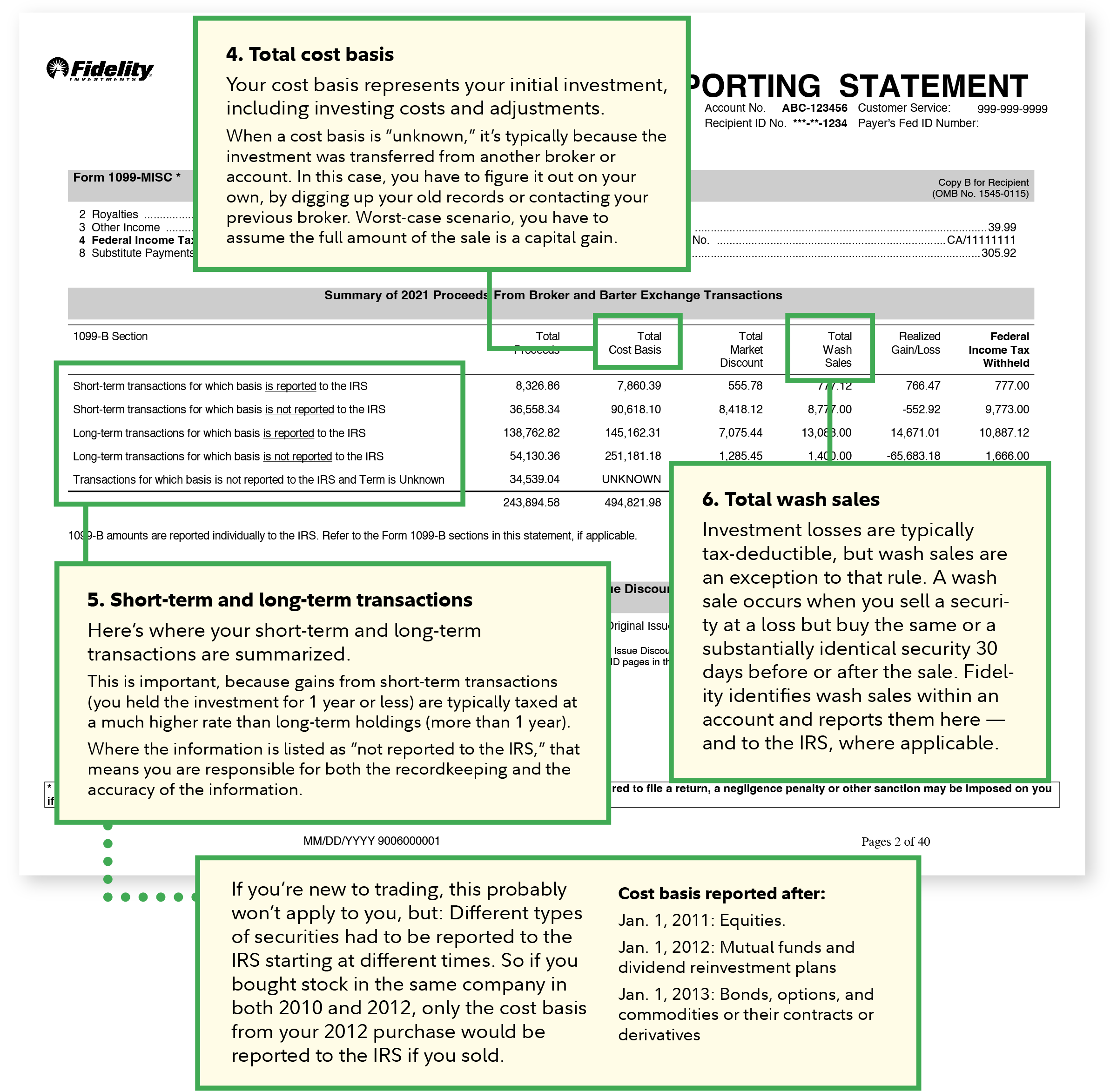

Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal.

. Alabama 186 114 alaska 023 055 Municipal. Featuring a Balanced Approach to Preserving Capital and Pursuing Income. Start a 7-day free trial now.

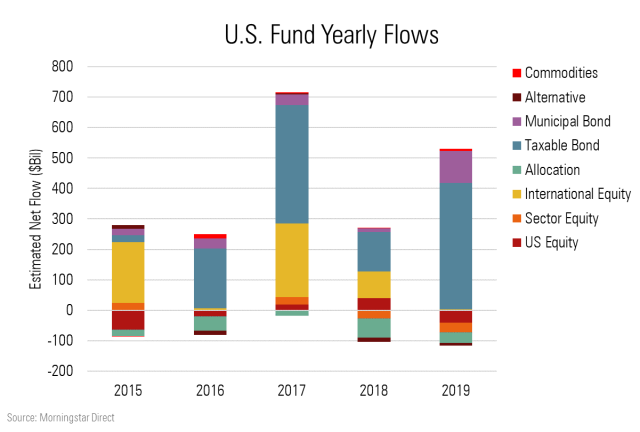

For state-specific funds TEYs are calculated by first dividing i that portion of a funds yield that is tax-exempt reduced for the potential effect of state income tax on the. Municipal buy tax-free bonds from local and state governments. Ad Weather the financial storm and protect your savings with Morningstar Investor.

Normally not investing in. Ad Discover a wide variety of municipal market investing opportunities. Analyst rating as of apr 19 2021.

The fund has returned -1273 percent over the past year -210 percent over the past three years 064 percent over the past five years and 203 percent over the past decade. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals. Get insights you can actually use.

Fidelity also offers tax-free municipal bond funds that focus on states such as California New York and. Nuveen wisconsin municipal bond fund. A number of funds have earned 4- and 5-star ratings.

Ad Take a Risk-Managed Approach to Income In a Yield-Starved World with BlackRocks MAYHX. Gain access and insights to the muni market with Invesco funds. Analyze the Fund Fidelity SAI Tax-Free Bond Fund having Symbol.

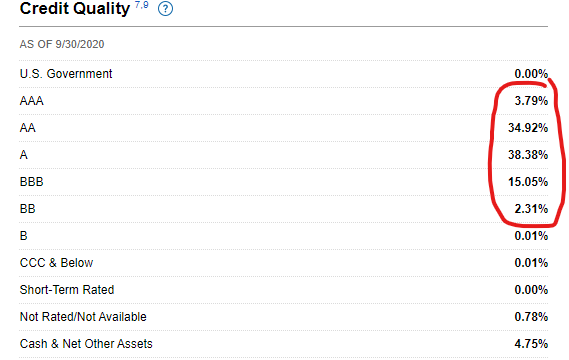

Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax. Most of the holdings are bonds issued by state and city governments. Ad Explore funds and choose those that align with your clients goals.

300000 in a tax. Learn About Our ETFs. Ad High-Rated Muni Bond Strategies.

Mutual Funds And Separately Managed Accounts Available. AJ Bell Favourite funds Funds can make investing easier. SEE MORE FTABX.

The fund is free from both federal income tax from the alternative minimum tax. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals. Find The Best Muni Bond Fund Here For Tax Advantaged Income Potential In Any Market.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Fidelity Tax-Free Bond Fund FTABX. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Tax Headaches A Dose Of Muni Bonds Might Help The New York Times

7 Of The Best Fidelity Bond Funds To Buy

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Fidelity Money Market Funds How To Choose The Best One

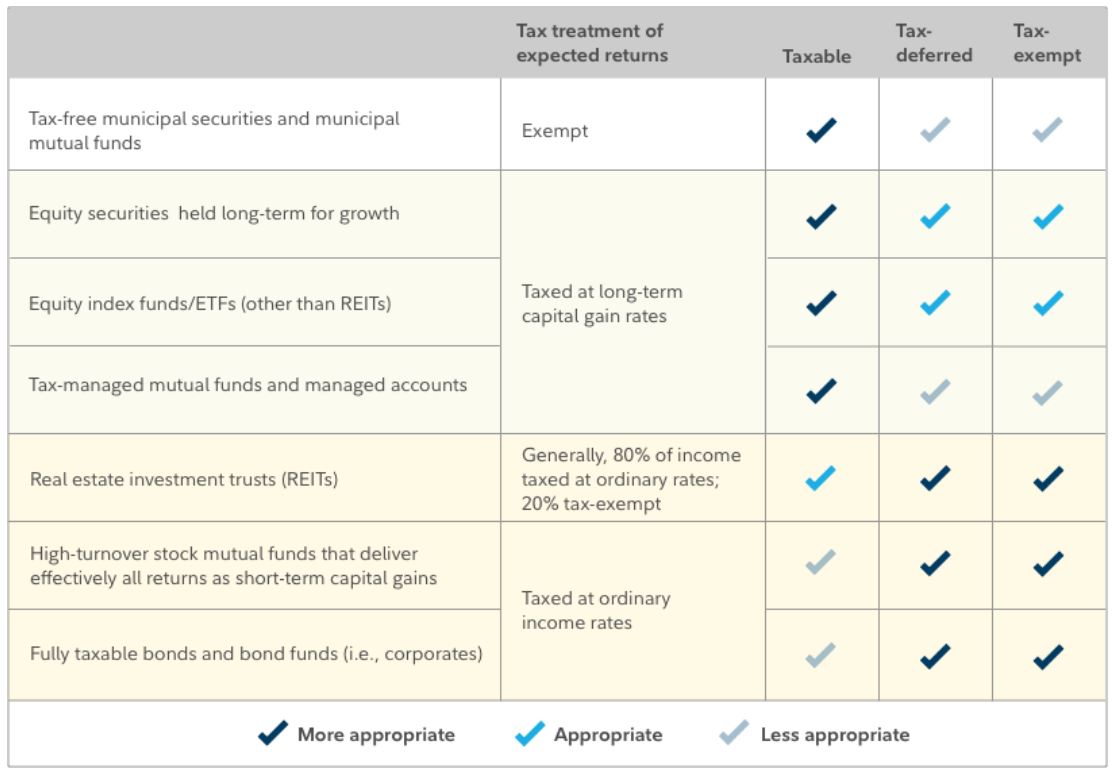

Taxes Investing Are Your Funds Tax Efficient

Fcstx Fidelity California Limited Term Tax Free Bond Fund Portfolio Holdings Aum 13f 13g

7 Of The Best Fidelity Bond Funds To Buy

Complete Guide To Tax Efficient Investing With An Etf Rotation System Theta Trend

Best Tax Efficient Funds Seeking Alpha

Fidelity California Municipal Trust 2019 Fidelity Bond 40 17g

Fidelity Undercuts Vanguard Again

7 Best Bond Index Funds To Buy

Fidelity Hit With Third Lawsuit Over Alleged Secret 401 K Fees Pensions Investments

Read This Before Buying Fidelity S Zero Fee Funds The Motley Fool